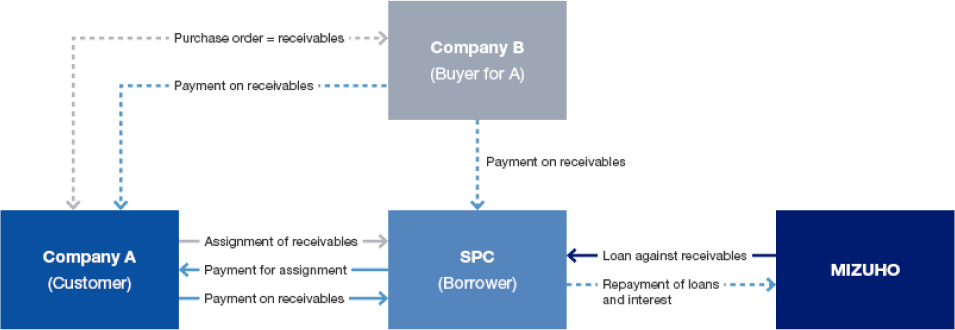

Receivables Finance

What It covers

- Non-cancelable limits

- Cover default, protracted default, insolvency and bankruptcy risks of an obligor

- Cover political risks including government default as an obligor or as a guarantor, currency conversion and/or currency transfer risks

- Factoring with and without recourse (on acknowledgement basis)

- Can cover receivables under one or multiple buyers

- Cover revolving lines up to 365-days credit terms

- Typically, up to 90% indemnity but 95% is considered