Insurance Solutions covering Capital Goods Manufacturing & Supply Agreements

What It covers

- Covers the post-delivery nonpayment risk, buyer default risk, buyer bankruptcy/insolvency risk on both international and/or domestic receivables from delivery of capital goods as well as tangible assets to single or multiple buyers under open account

- Cover for unconfirmed LCs against the non-payment of the issuing bank.

- Covers the supplier pre-delivery manufacturing costs in cases of repudiation and breach of contract by the buyer

- Covers the buyer’s advance payment risks in cases of repudiation and breach of contract by the supplier

- Cover lease agreements

- Cover political risks including currency conversion and currency transfer restrictions, government imposed import/export embargos, government imposed license cancelations and nationalization acts.

- Can be designed as a ground-up, top-up and/or excess of loss (EOL)

- Buyer credit limits can be approved subject to pre-agreed credit opinions/reports

- Premium can be based on the expected annual turnover

- Policies cover both commercial and political risks up to 95%.

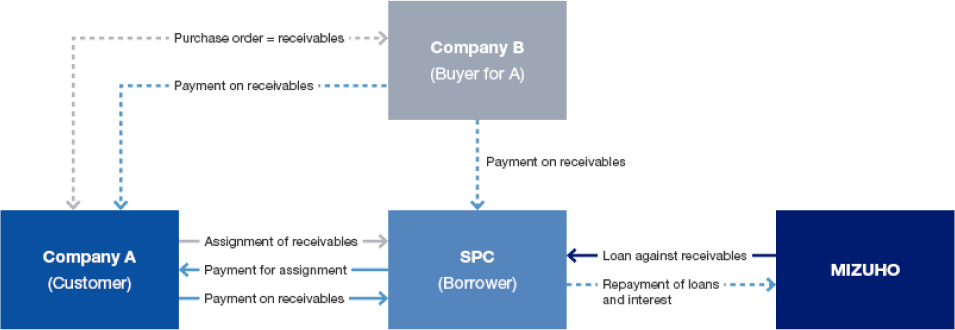

- Subject to approval, policy proceeds (claim payments) may be assigned to a financial institution to arrange receivables financing or to add insured accounts receivable to the borrowing base

- Payment terms up to five years can be covered under single contracts